Why Stocks Shrugged Off Iran Escalation

Published Friday, January 3, 2020 at: 7:00 AM EST

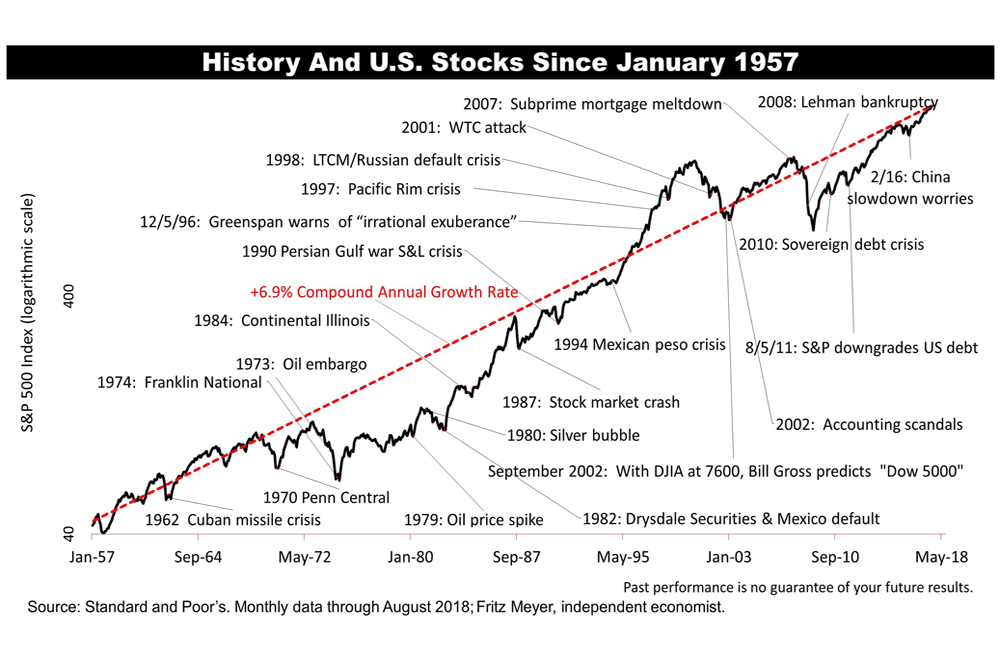

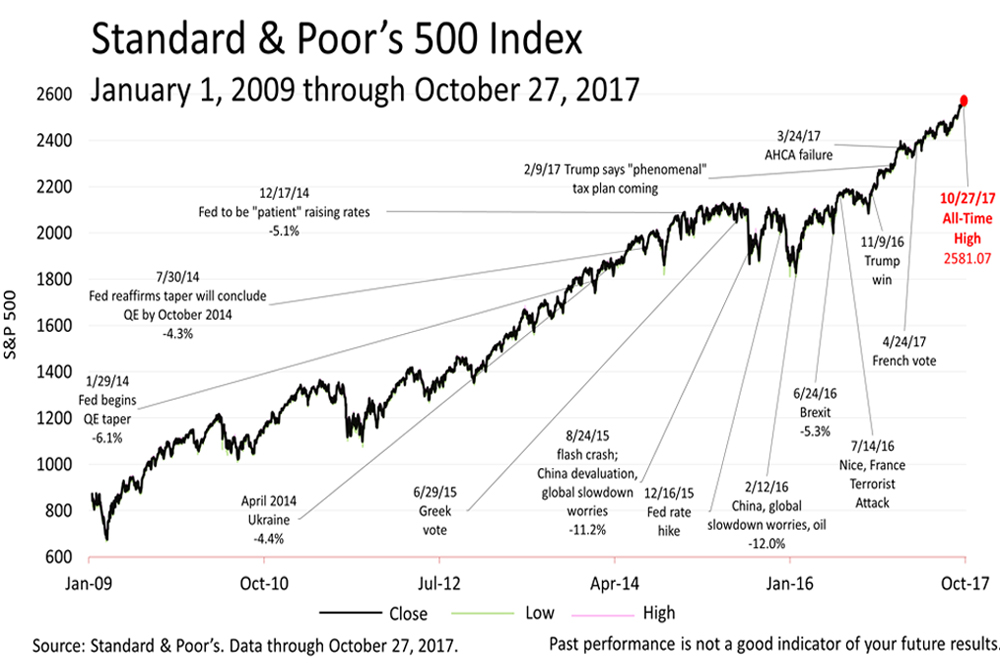

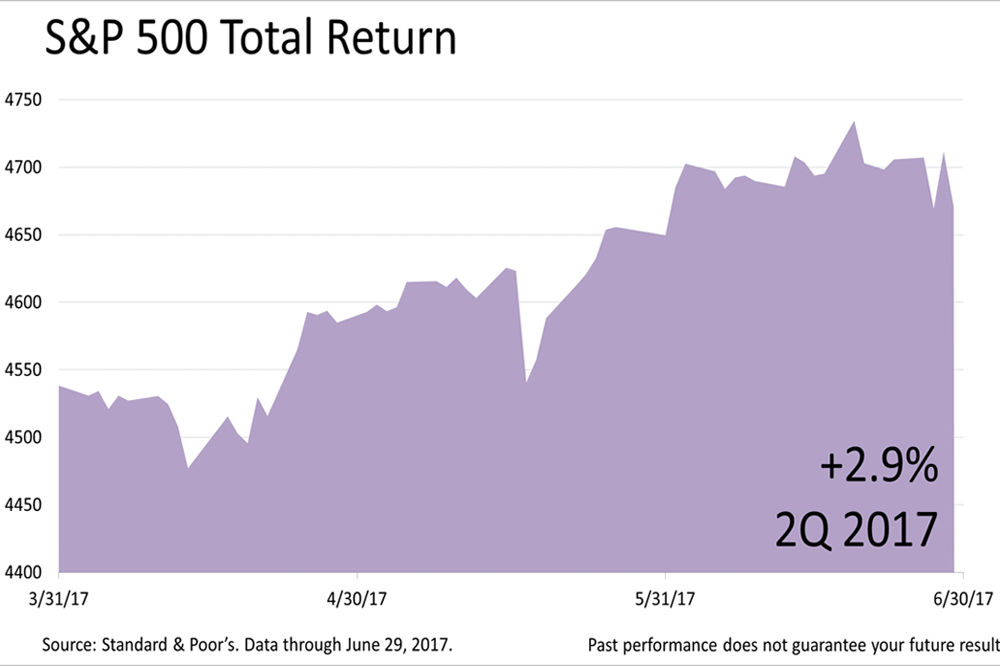

As the U.S. Government was reportedly sending additional troops to the Mideast, after killing a top Iranian leader, fear of Iran's asymmetric warfare tactics spread. The Standard & Poor's 500 stock index closed slightly lower than yesterday's 3,257.85 all-time high, ending on Friday at 3,234.85.

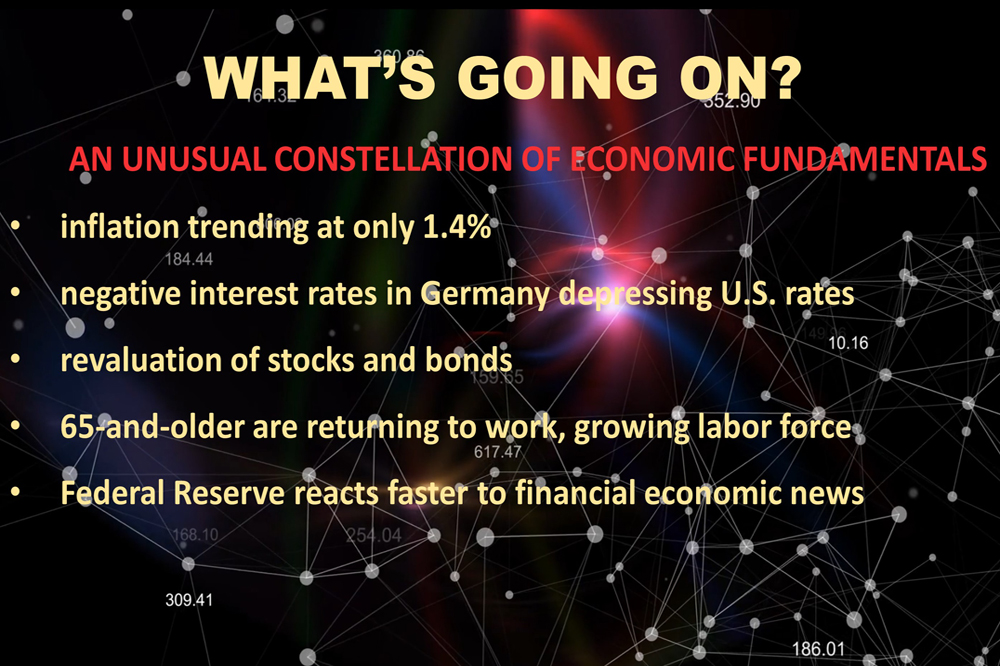

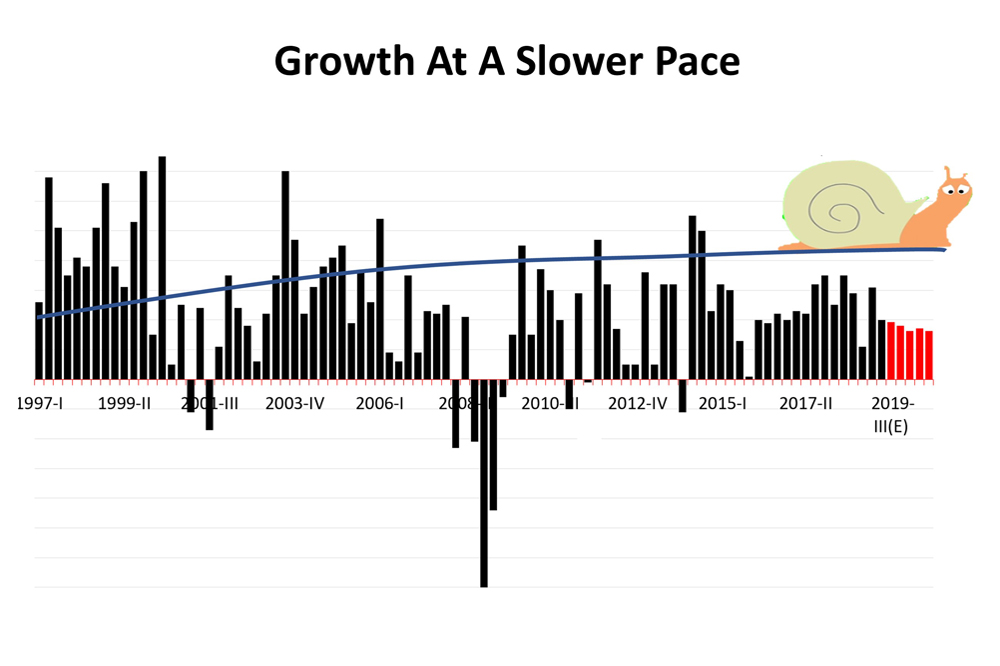

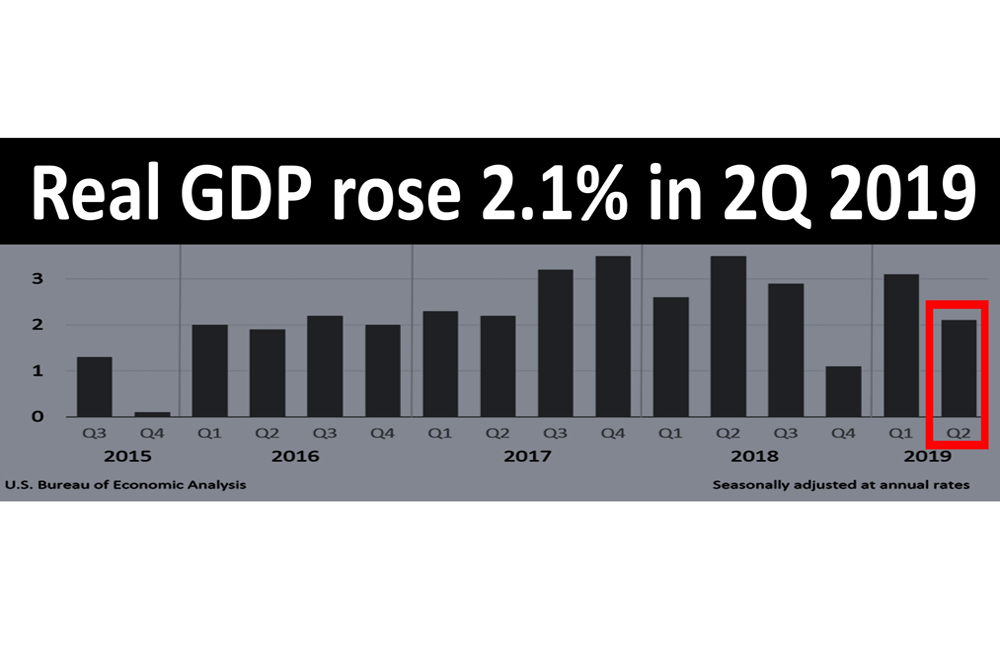

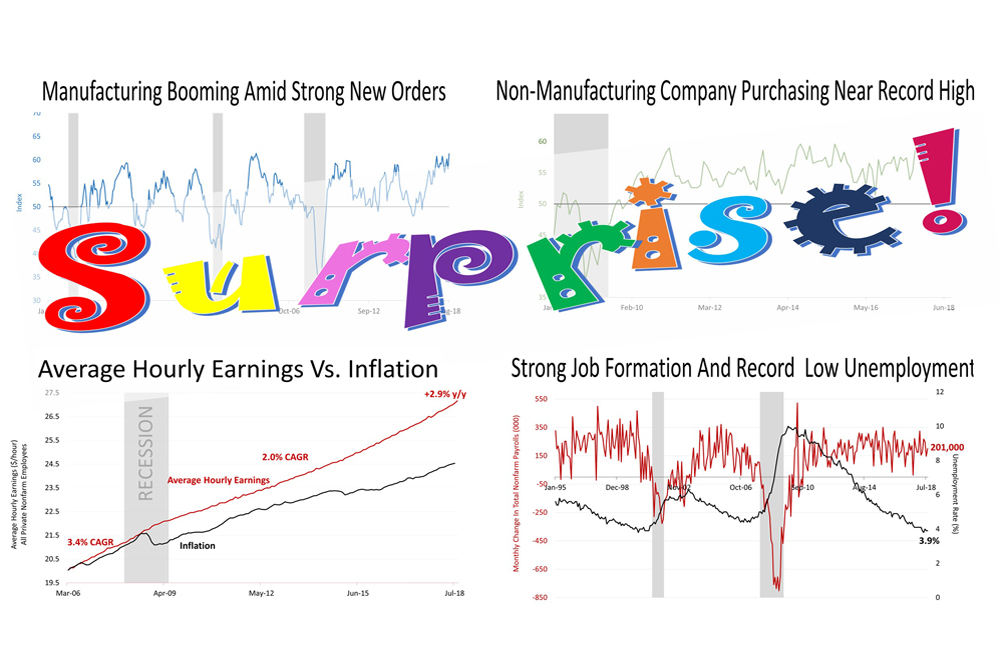

Here's why: The U.S. economy is expected to grow 2% after inflation in 2020.

That's not roaring growth, but the Fed's projections as of December 11th, 2019 were realistic and make it likely that the 10½-year old expansion will continue despite the new foreign crisis.

Although a war with Iran would present serious new risks, not to mention ethical questions, the evidence shows that the U.S. consumer's behavior is not much affected by foreign conflicts.

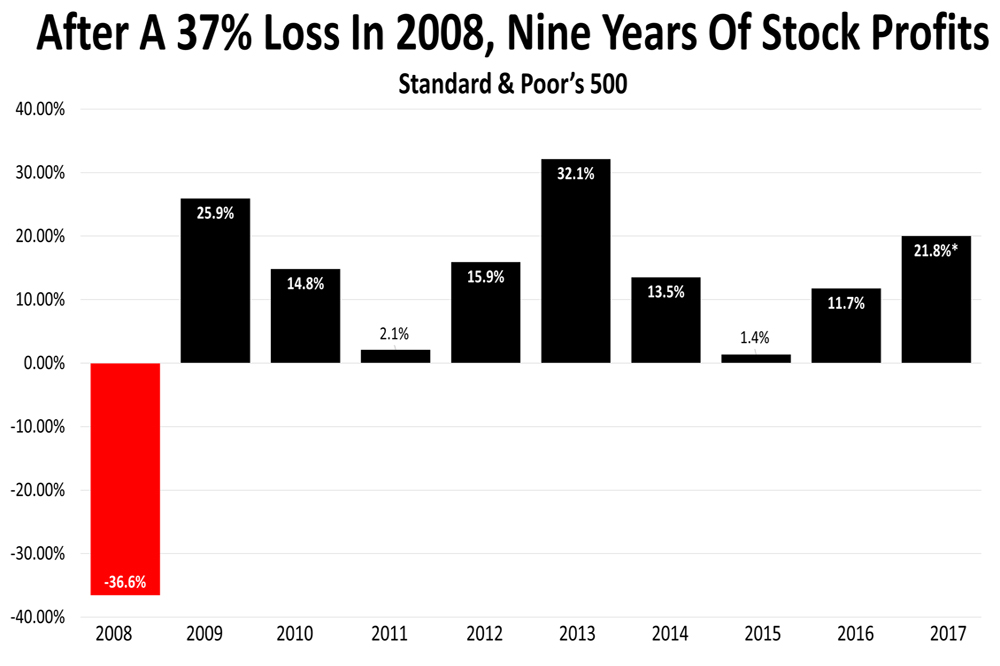

The U.S.-China trade war did not prevent the stock market from rising nearly 30% in 2019. Brexit did not stop the bull market. The bull market kept right on going.

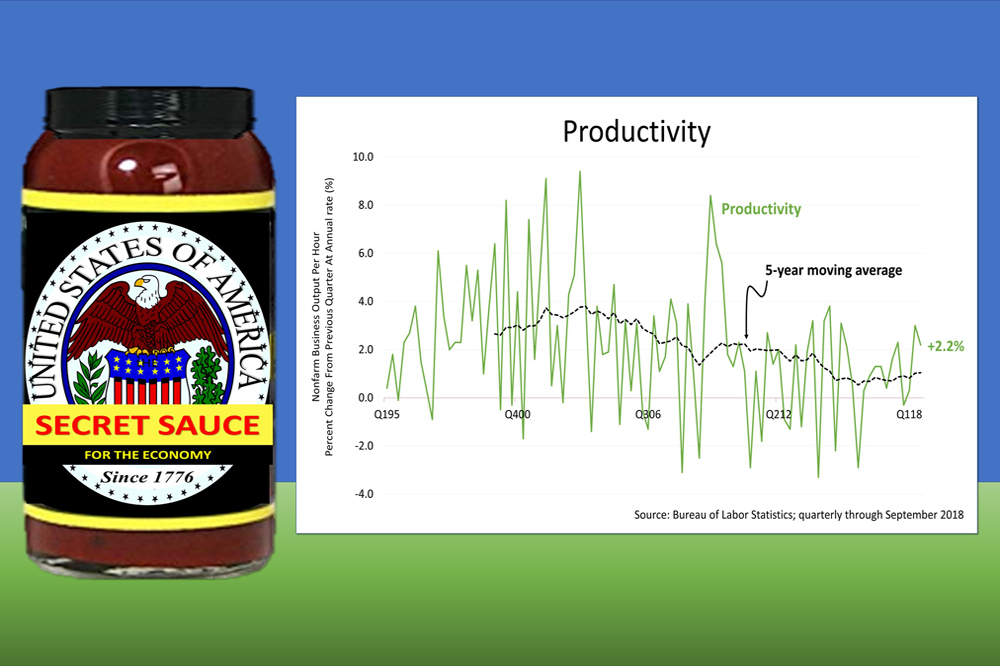

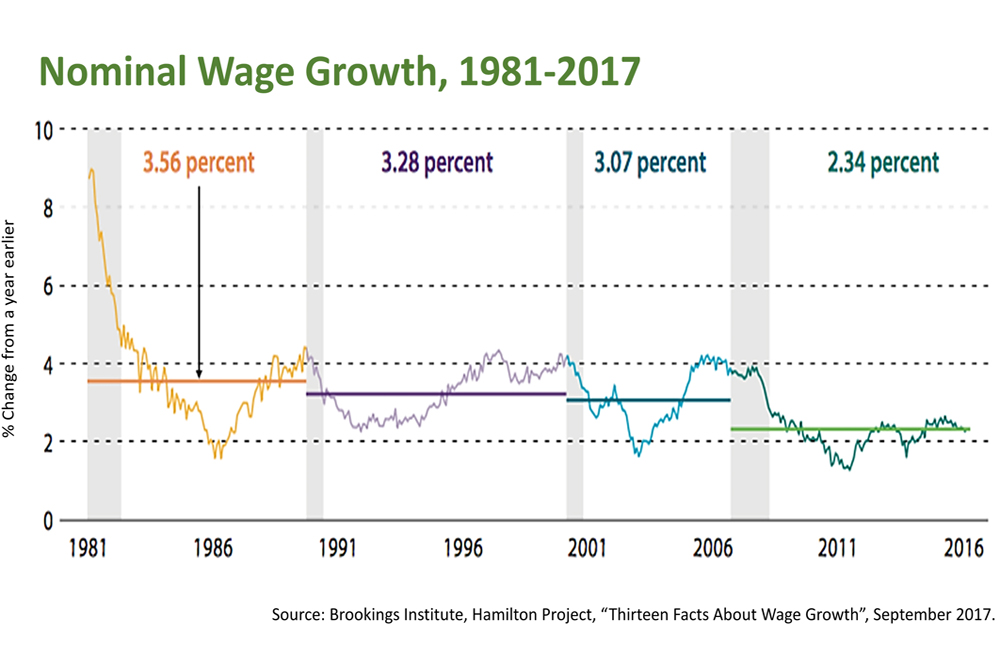

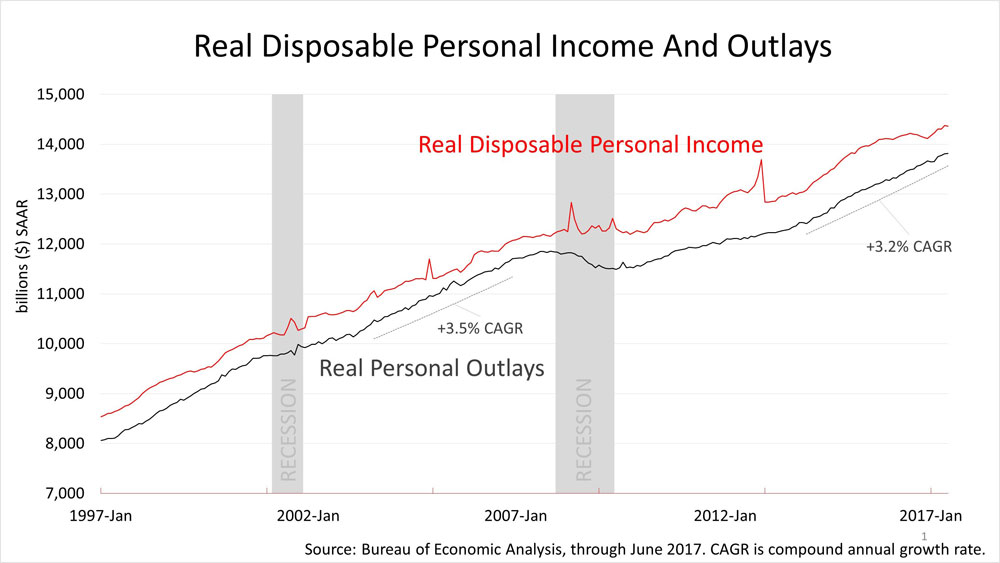

The U.S. is exceptional among world economies because the consumer population makes 75% of U.S. gross domestic product and they keep growing in wealth by objective standards — despite foreign crises, politics, and ephemeral distractions.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

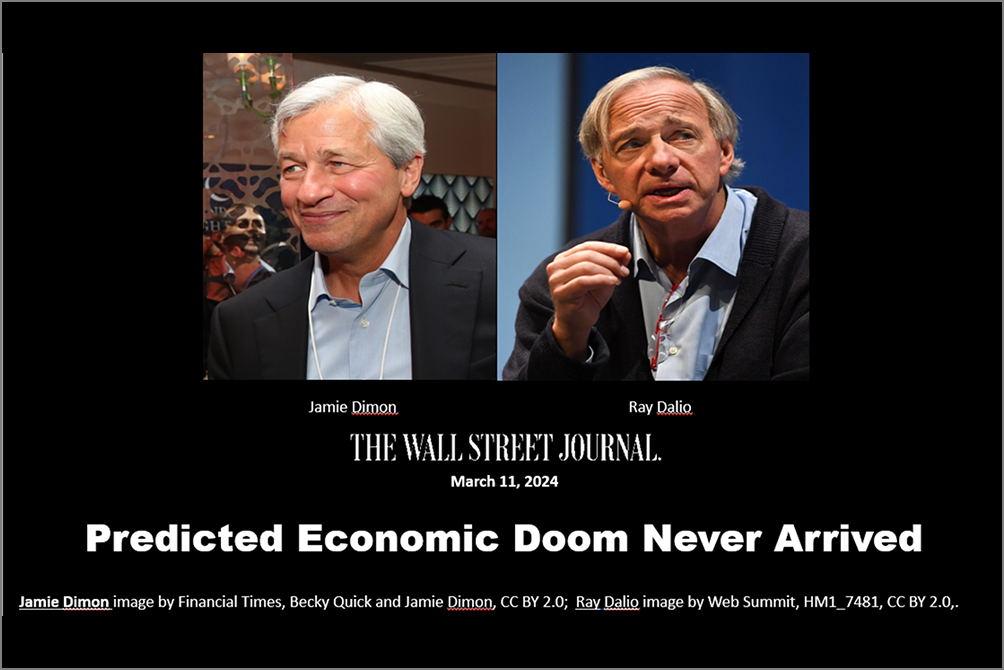

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding