Amid The Crisis In The Economy, Two Good Anomalies

Published May 1, 2020, 8 p.m. EST

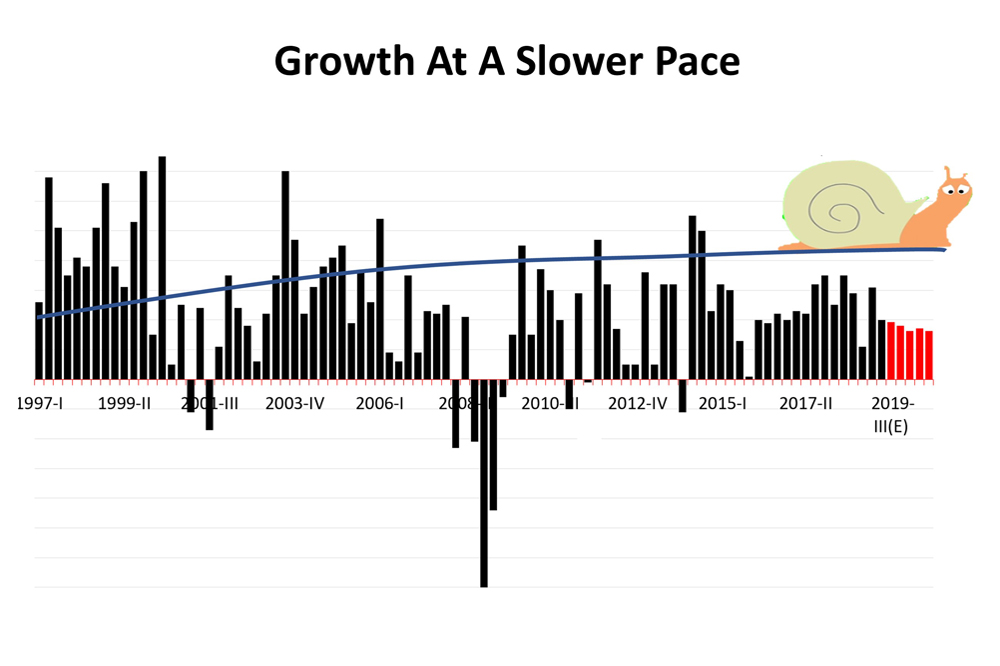

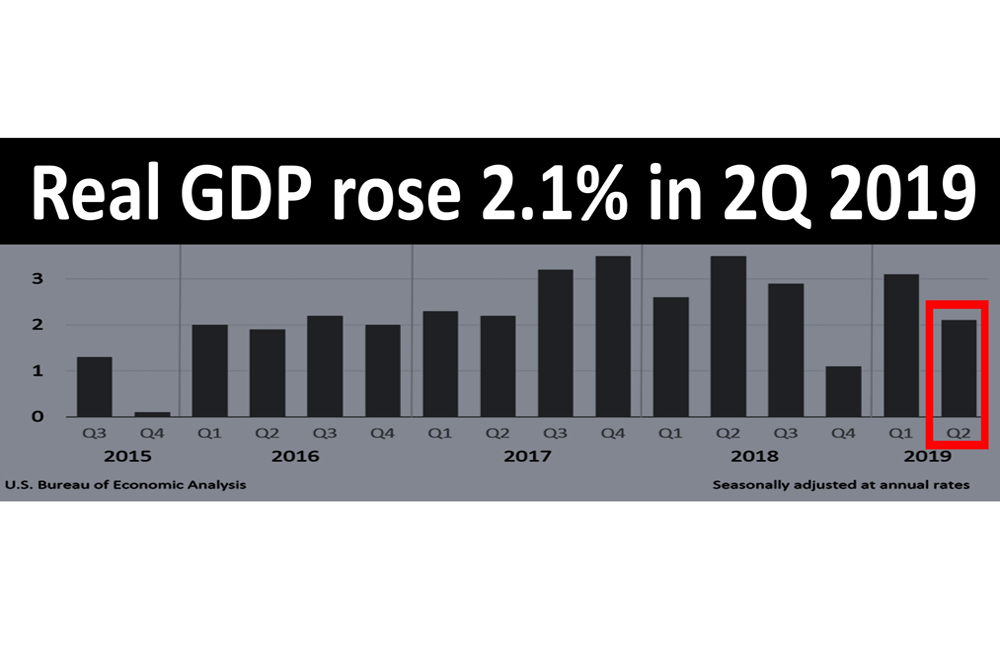

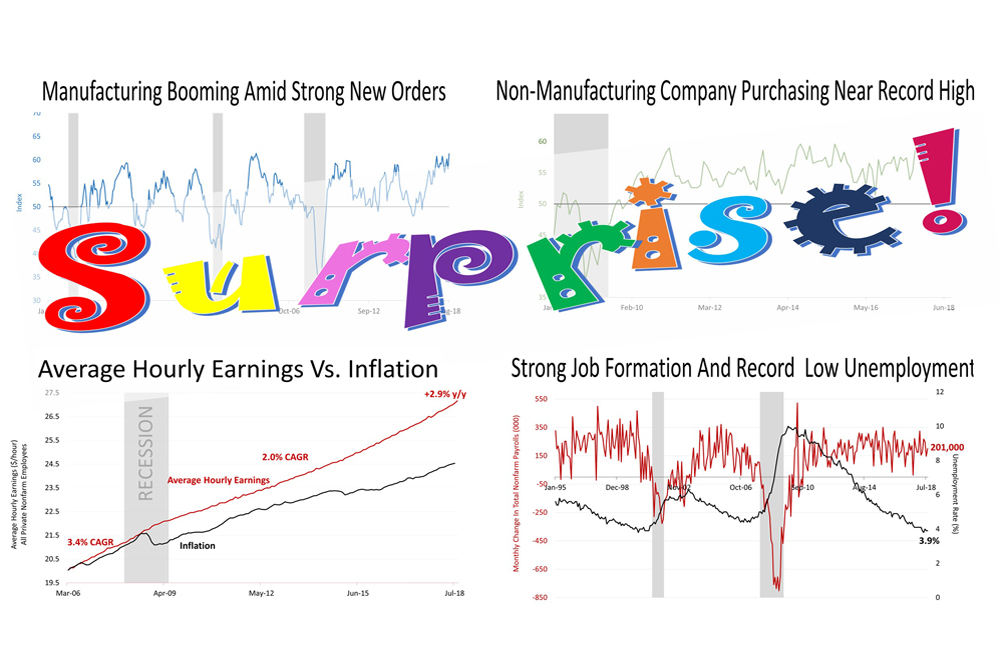

- The U.S. economy in the first quarter of 2020 shrunk by 4.8%, and the second-quarter is expected to be five times worse due to the partial shutdown of the economy.

Consumption plunged at a rate never before experienced, according to the newly released data from the U.S. Bureau of Economic Analysis.

Right now, a severe contraction is underway. The consensus forecast of the 60 economists surveyed in early April by The Wall Street Journal was that the U.S. would shrink 25.3% in the second quarter, and this terrible quarter would be followed by strong economic growth of more than 6% for the next three quarters. These economists are the top names in the field.

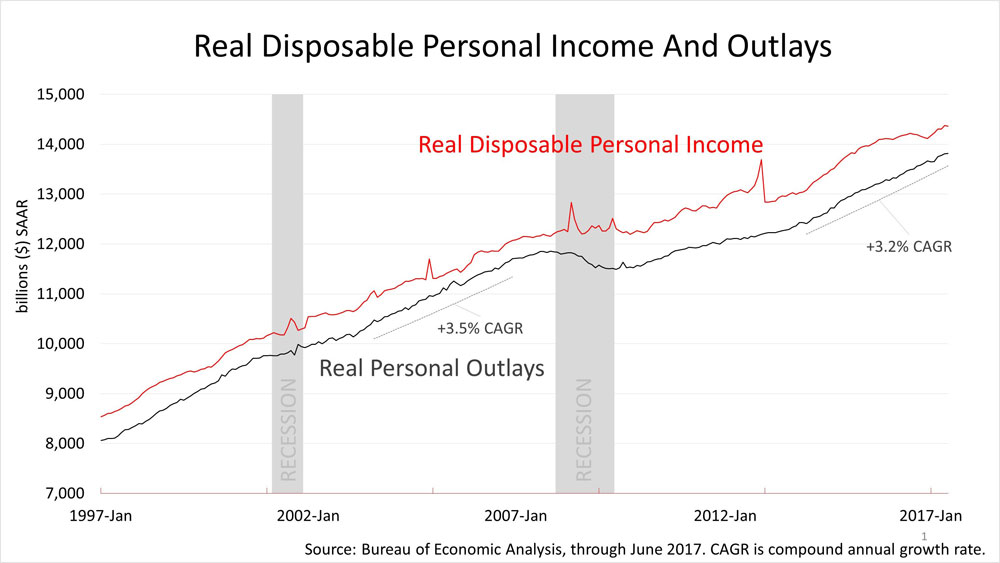

With Americans under stay at home edicts in March, and not consuming, the savings rate boomed. And this is not the only anomalous piece of good news.

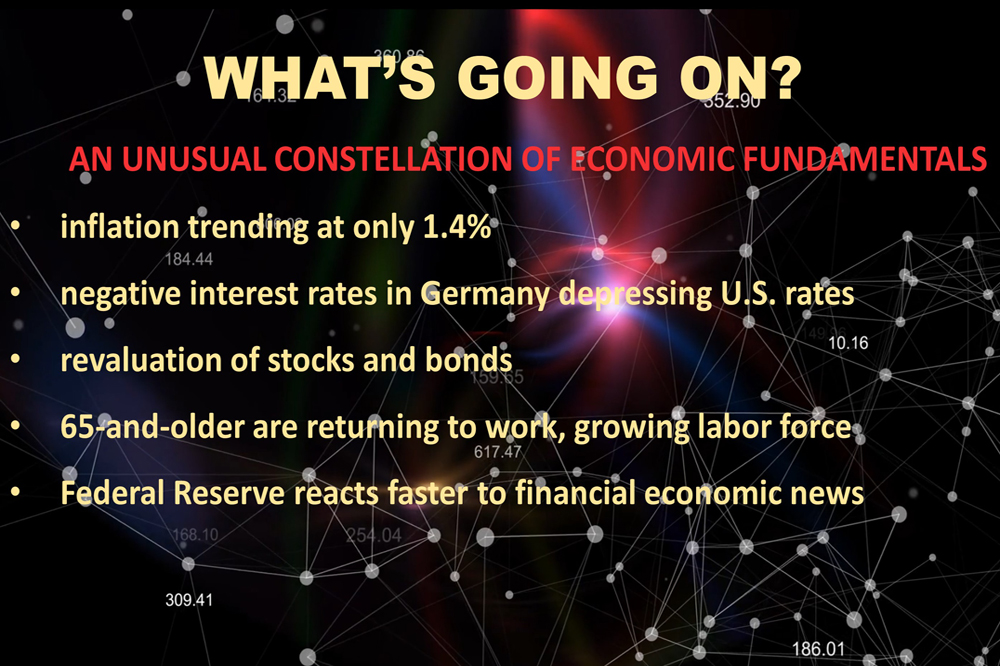

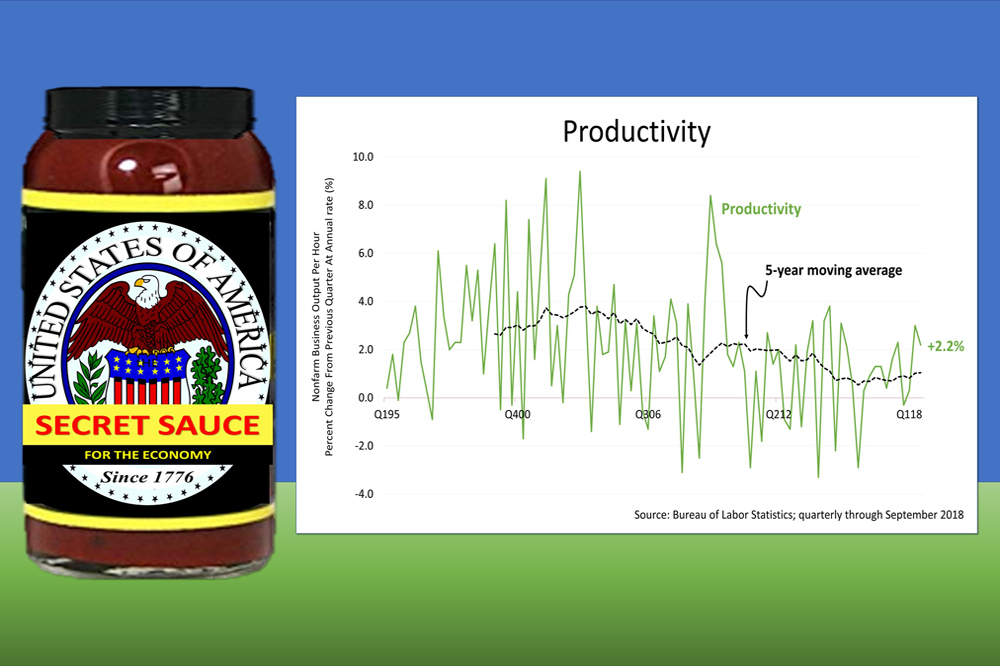

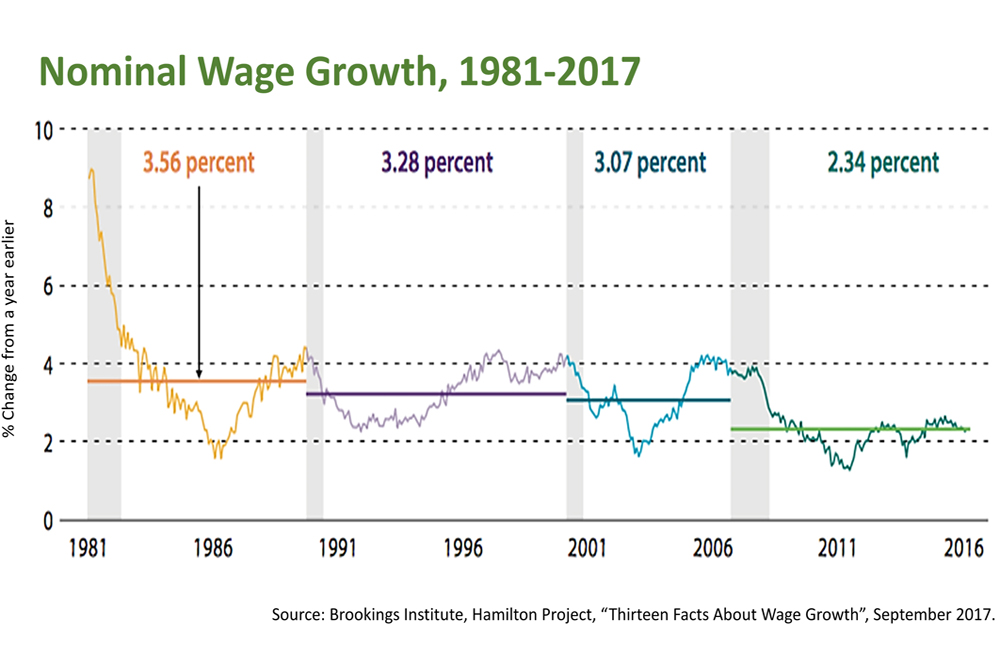

Inflation is nowhere near the Federal Reserve's 2% target. The inflation index against which the Fed sets policy, the Personal Consumption Deflator (PCED) has been at trending at 1.5% for a decade, and it does not look like we're headed toward the 2% rate of inflation anytime soon. That means the Fed can expand the money supply without worrying much about rousing inflation.

With inflation low even though interest rates are near zero, liquefying the economy through U.S. Government largesse via the Paycheck Protection Program, Supplemental Nutrition Assistance Program (SNAP), and boosting unemployment insurance compensation payments, adds a negligible amount to the long term debt.

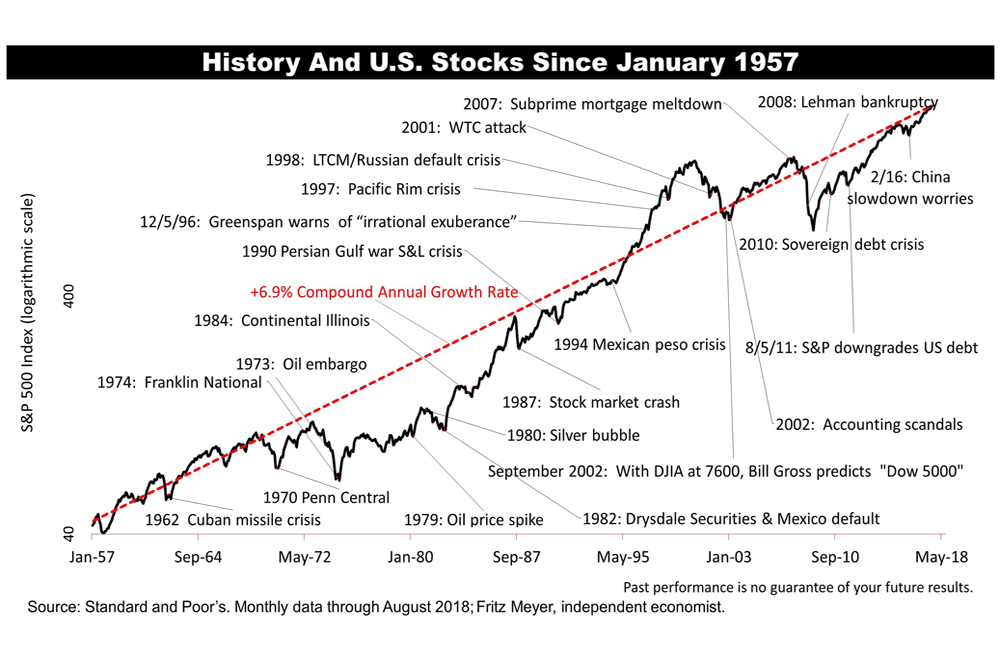

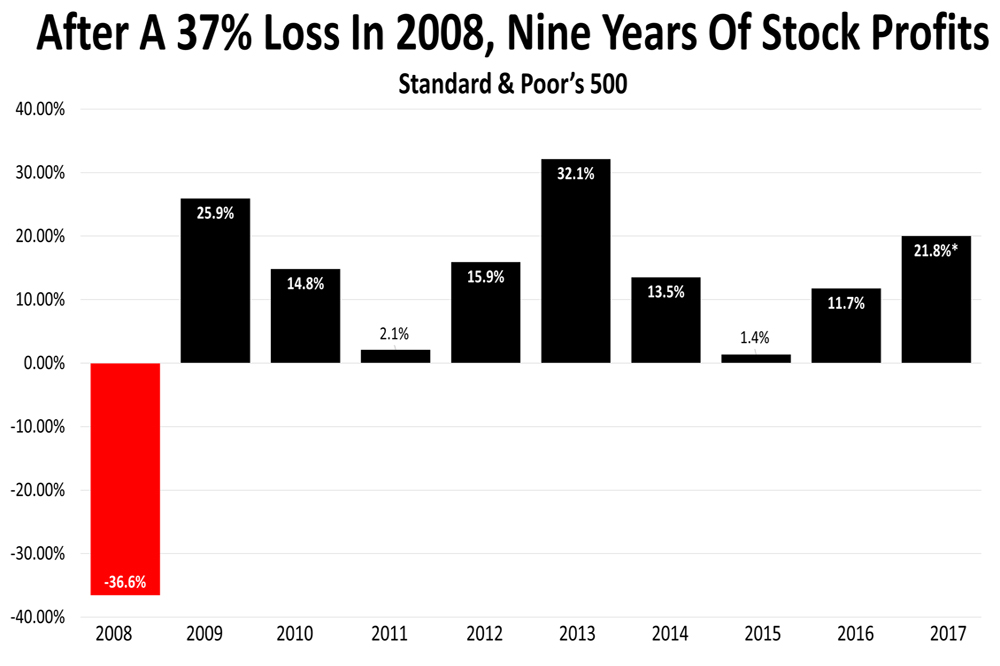

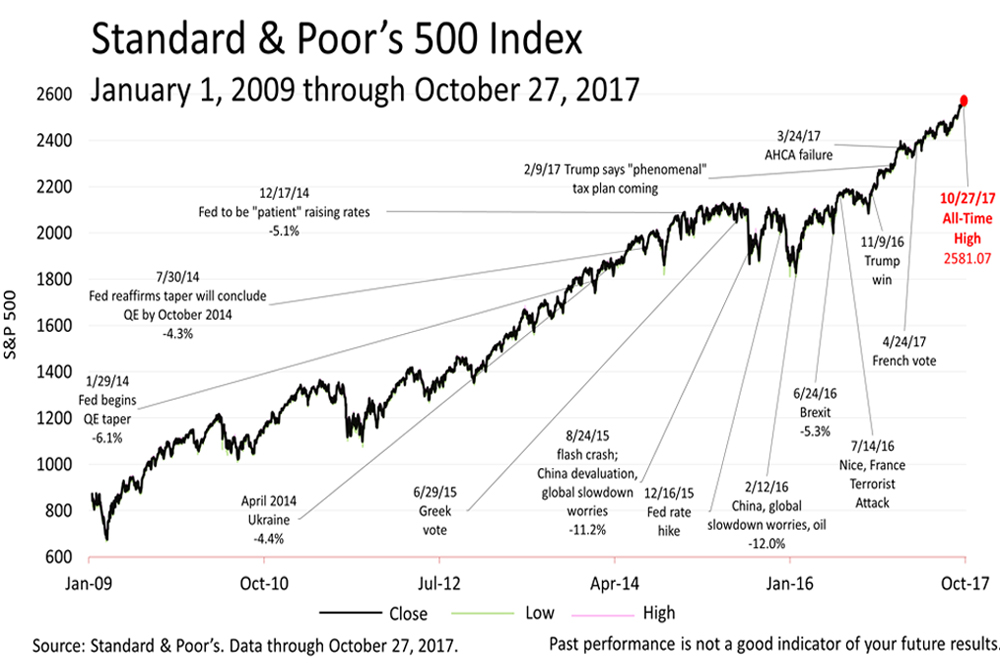

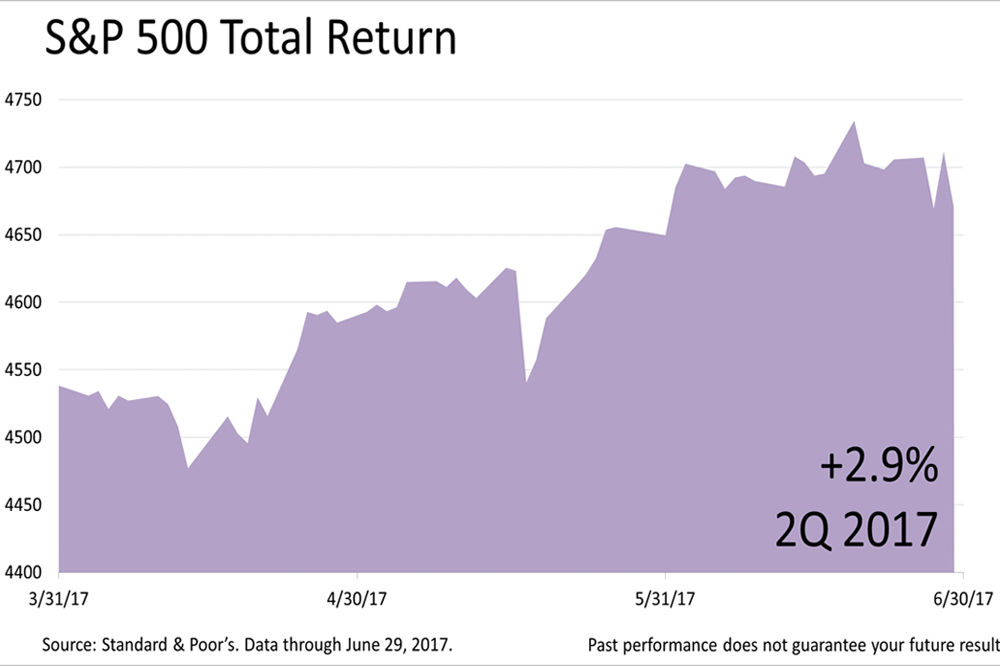

The Coronavirus bear market low on the Standard & Poor's 500 index was 2237.39 on March 23, 2020. Today, the S&P 500 closed at 2830.71, down a sliver from last week.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial situation, or particular needs. Product suitability must be independently determined for each individual investor.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

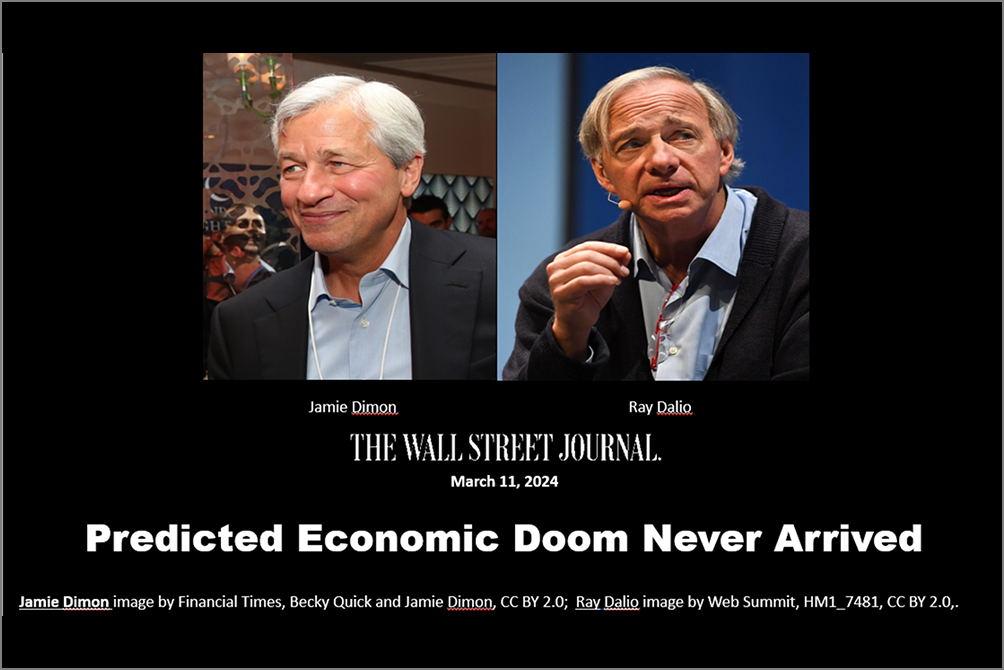

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding