Fed Signals It's Thinking About Starting To Talk About Tightening

Published Friday, May 21, 2021 at: 6:26 PM EDT

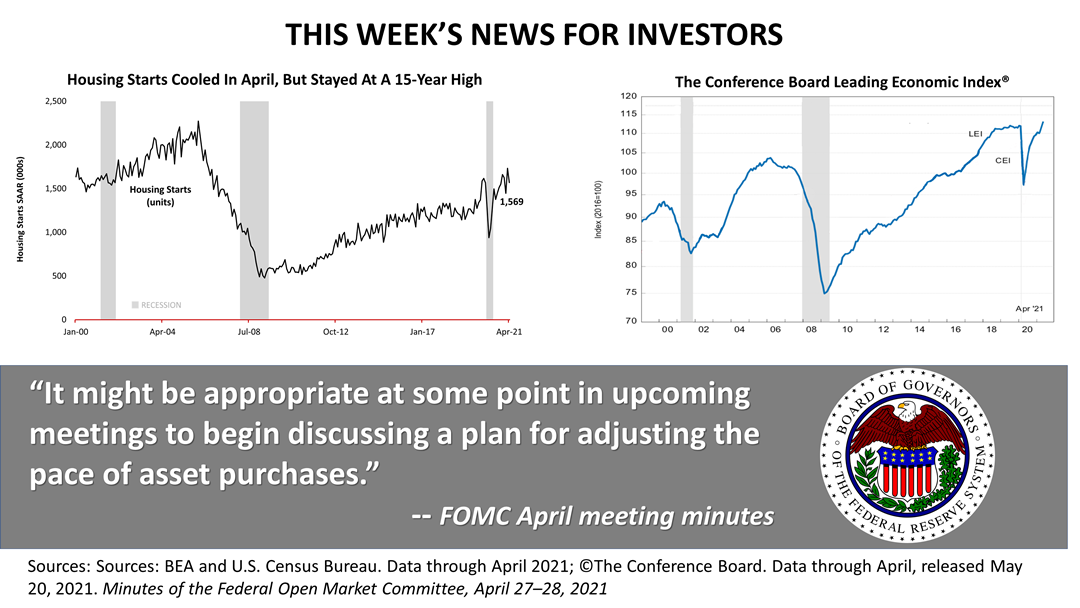

The U.S. Index of Leading Economic Indicators hit an all-time high and housing starts weakened but were still at a 15-year high. Amid the booming April data released this past week, the big news for investors was in the release of the minutes from the Federal Reserve’s monetary policy meeting on April 27 and 28, revealing that some members of the Federal Open Market Committee (FOMC) want to begin talking about cooling down the fast growth of the economy.

On page 10 of the 11-pages of minutes published by the Fed three weeks after every FOMC’s meeting, the Fed gently signaled to investors that it was thinking about starting to talk about a plan to taper purchases of bonds, a liquidity measure likely to precede a hike in the Fed’s lending rate to banks. While tapering is likely not to begin until 2022, the Fed is sending an early warning signal to investors.

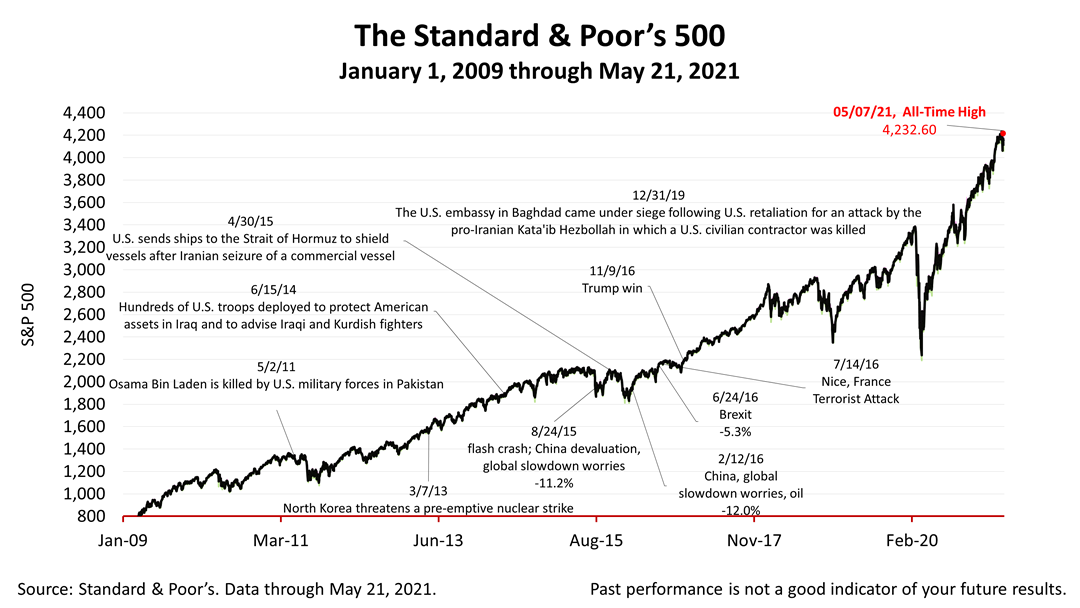

The Standard & Poor’s 500 stock index closed Friday at 4,155.86, about 2.5% from its all-time high. The index lost -0.08% from Thursday and -0.43% from last week. The index is up +60.01% from the March 23rd bear market low.

It was the second week in a row that the S&P 500 declined amid nervousness about inflation and Fed policy.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding